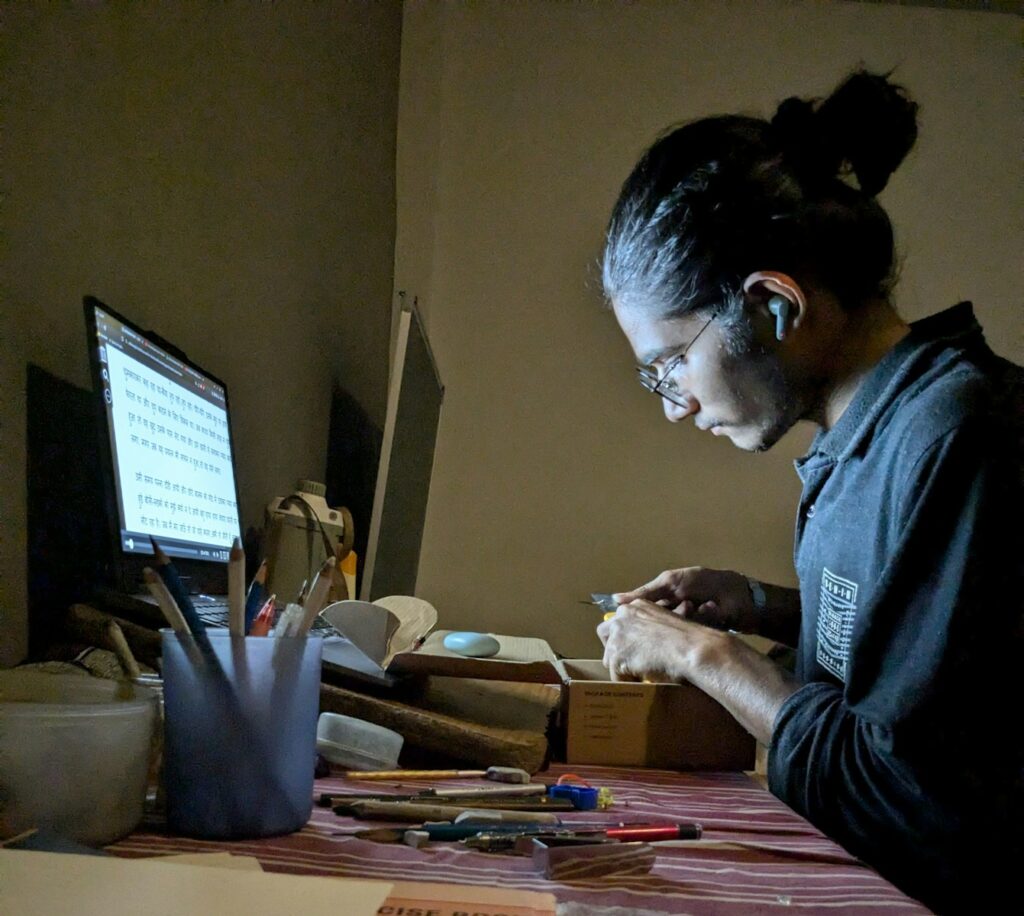

Most people believe that wealth is built on big, dramatic decisions—but in reality, small, everyday financial habits quietly shape our futures.

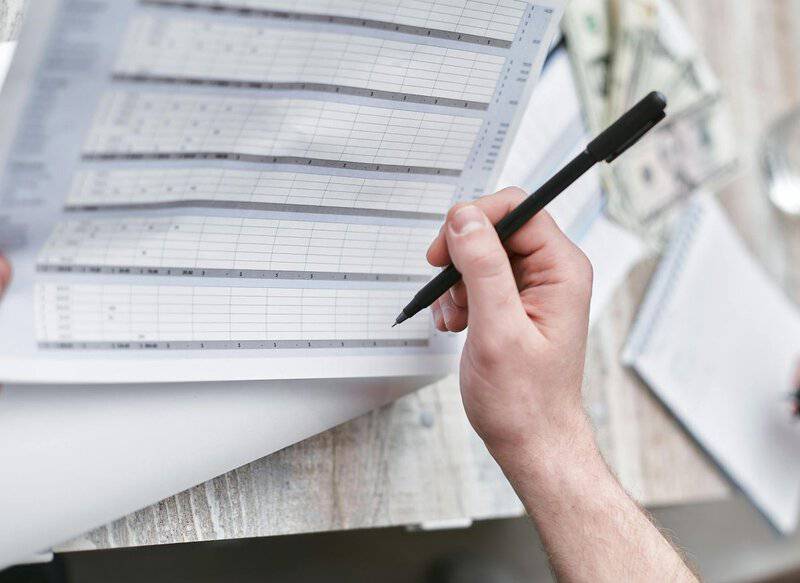

It’s these unnoticed choices—what we buy, how we save, and where we invest—that can silently erode hard-earned money over time.

What’s more, these patterns often get passed down, trapping families in the same cycle of financial struggle for generations.

Recognizing and breaking free from these common money mistakes is the first, crucial step toward lasting financial security and upward mobility.